As Congress continues to debate tax reform, it’s important to take a moment to explain just what that is and what it means for American manufacturing jobs.

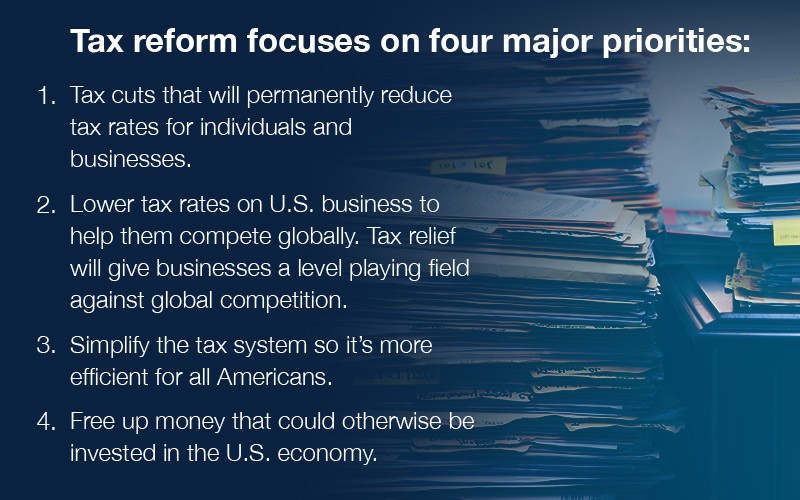

Tax reform is more than just tax cuts — it refers to broad, sweeping changes to the entire tax system.

So what does this mean for hardworking Americans? Tax reform will help American businesses, like Boeing, compete globally and create opportunities in the U.S. Today, the U.S. has one of the highest corporate tax rates in the industrialized world. A lower tax rate will help American companies win in the global economy, while driving growth, innovation and investment in the U.S.

It is an important tool to energize the economy and creates more opportunity for each and every American.

Follow the latest on the tax reform proposal as it continues through Congress.